As Insurtech continues to evolve, a clear shift is emerging. The most successful platforms no longer aim to replace licensed insurance agents; they empower them. The future of insurance lies in agent-centric platforms, where AI and automation enhance the capabilities of human agents instead of removing them. For CTOs, product leaders, and founders in the insurance space, embracing this approach unlocks operational efficiency while preserving trust and human connection.

What Does “Agent-Centric” Really Mean?

An agent-centric Insurtech platform is designed around the needs, workflows, and goals of licensed agents. These platforms do not eliminate the agent’s role, but amplify it through:

- Task Automation: Automate repetitive, time-consuming tasks like quote generation or policy updates

- Smart Dashboards: Explore real-time recommendations and data insights

- Integrated Communication: Deploy communication tools that simplify customer interactions

- Flexible Customer Journeys: Agile design that supports both self-service and agent-assisted customer journeys

By keeping agents at the center, these platforms ensure better experiences for customers and more productive, confident agents.

Why This Matters Now

Three market dynamics make the agent-centric model especially relevant today:

- Complex policies still require human judgment. Customers trust licensed agents for nuanced advice and high-value decisions.

- Compliance and regulations are increasing. Managing privacy, disclosures, and multi-state licensing demands human oversight alongside automated systems.

- Agent burnout is real. As administrative tasks grow, more agents are leaving the industry. Technology that relieves their burden is essential to keeping experienced talent engaged.

How Agent Plus AI Delivers Measurable Value

Combining agent expertise with AI-powered tools creates meaningful business outcomes:

- Faster responses through intelligent form filling, data retrieval, and workflow automation

- Higher conversion rates by surfacing personalized recommendations and next-best actions

- Reduced error rates as automated systems flag inconsistencies or compliance gaps

- Greater job satisfaction by allowing agents to focus on customer relationships rather than paperwork

The result is a win-win: better outcomes for both customers and agents, with platforms that scale smoothly and efficiently.

The Technology Behind Agent-Centric Insurtech

To build a truly agent-centric platform, you need a modern and modular tech foundation. This includes:

- AI and ML models to power document processing, underwriting, and lead scoring

- Real-time integrations with CRMs and AMS systems using APIs

- Custom agent dashboards built for responsiveness, clarity, and productivity

- Strong security protocols and compliance alignment with frameworks like ISO 27001 and HIPAA where applicable

Together, these components deliver tools that enhance—not interrupt—the agent workflow.

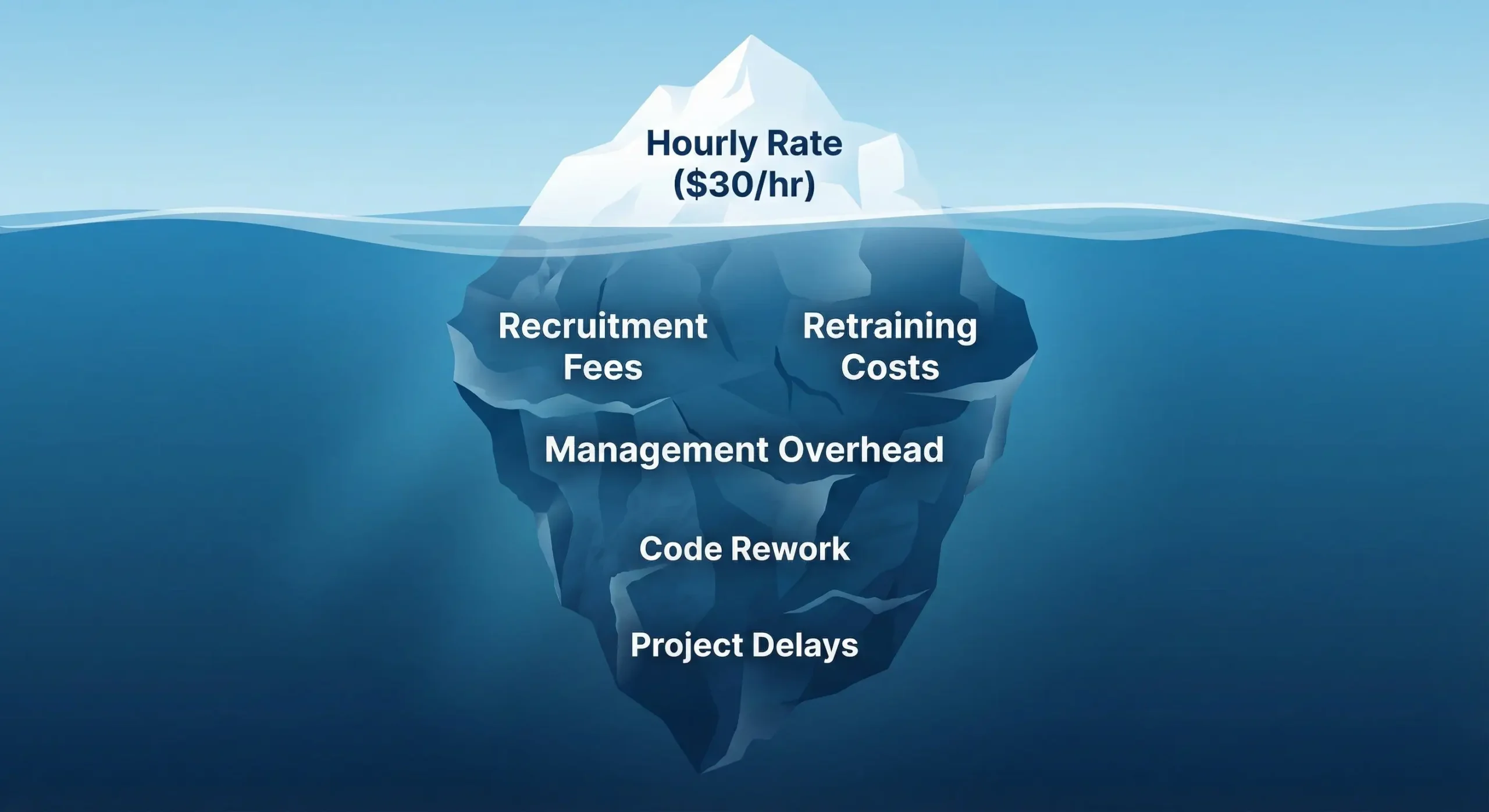

Why Offshore Talent Is the Key to Building at Scale

As Insurtech startups and mid-stage companies seek to accelerate development, specialized offshore talent provides both agility and long-term value:

- Teams trained in domain-specific workflows like policy management or claims automation

- Experience with secure, scalable cloud infrastructure

- Higher retention rates and lower onboarding costs compared to high-turnover markets

- Cost efficiency that allows reinvestment into product innovation and user experience

Nepal offers an emerging engineering ecosystem with proven delivery capabilities in data-intensive, compliance-driven industries.

TechKraft’s Build Operate Transfer (BOT) Model for Insurtech

For companies looking to scale fast while retaining future control, TechKraft offers a BOT engagement model:

- Build: We assemble and train a dedicated offshore team aligned to your platform’s needs

- Operate: Our team runs the day-to-day operations, including delivery, governance, and team management

- Transfer: When the time is right, we hand over full ownership—talent, systems, and knowledge—to your internal leadership

This model eliminates upfront investment risk and accelerates time to market while ensuring full control as your product and operations mature.

What Comes Next: A Roadmap to Agent-Centric AI

To evolve into an agent-centric, AI-enabled platform, Insurtech leaders should:

- Map out core agent workflows, identifying friction points and automation opportunities

- Define pilot AI capabilities such as smart quoting, renewal triggers, or claim triage

- Partner with experienced teams who understand the regulatory, UX, and technical requirements

- Scale and iterate using Agile delivery methods, supported by secure, cross-functional engineering teams

With the right foundation, companies can deliver powerful tools that scale with both business growth and customer expectations.

Final Thoughts

The future of Insurtech doesn’t exclude agents—it empowers them. Companies that invest in agent-centric platforms will not only improve customer satisfaction but also gain a competitive edge through loyalty, trust, and scalable automation.

At TechKraft, we specialize in building compliant, AI-enabled platforms that support hybrid insurance distribution. Whether you’re in early product development or preparing to scale nationally, our teams are built for secure, rapid, and strategic delivery.

Ready to build smarter, agent-first Insurtech solutions?

learn how our Build Operate Transfer model and domain-trained teams can accelerate your vision.