For the past two decades, the offshore narrative has been dominated by a singular variable: cost arbitrage. However, as the digital economy enters a phase of hyper-specialization and AI-integrated workflows, the “Race to the Bottom” on hourly rates has hit a hard wall of diminishing returns.

The 2026 market is no longer defined by who can offer the lowest hourly rate. Instead, it is defined by who can offer the highest efficiency per dollar. We define this metric in this report as the “Velocity-to-Cost Ratio.

This report provides a data-driven comparison of three primary contenders in the Asian offshore market. These are India, the established incumbent; Vietnam, the dynamic challenger; and Nepal, the emerging high-performance specialist. Our analysis triangulates data across five critical areas: Talent Stability, Economic Efficiency, Engineering Maturity, Operational Resilience and Cultural Alignment.

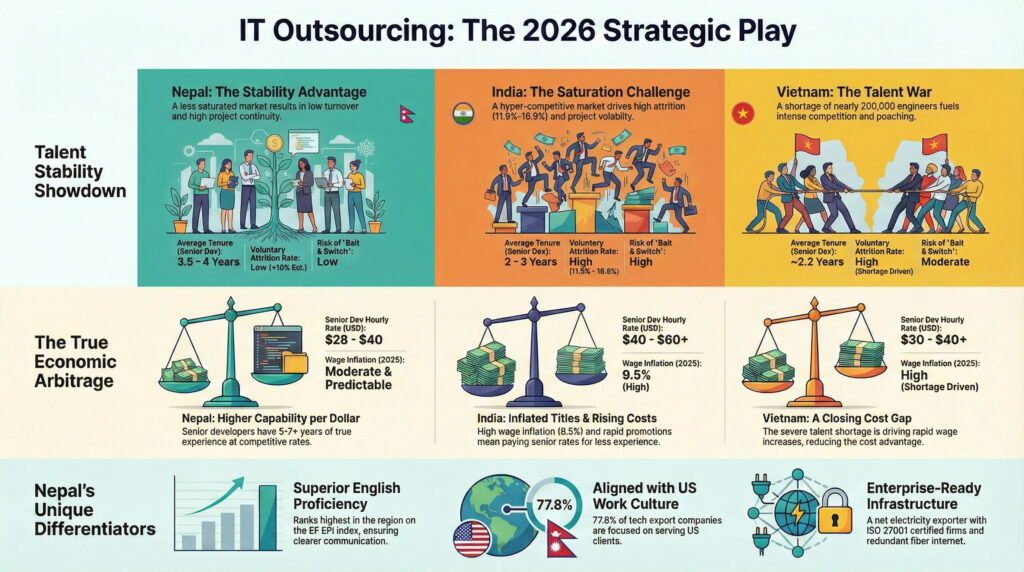

The findings, grounded in 2024-2025 market data, reveal a critical divergence in value propositions. India remains the volume leader but grapples with saturation-induced inefficiencies and wage inflation projected at 9.5% for 2025. Vietnam has successfully positioned itself as a major IT hub, moving beyond its manufacturing roots, yet it faces a projected deficit of nearly 200,000 engineers. This shortage is driving salary inflation and increased competition for talent.

In this context, Nepal emerges as a strategic “High-Retention, High-Proficiency” alternative. Data indicates that Nepal’s IT service exports have surged, with a massive 64.2% growth since 2021, signaling a transition from a freelance economy to a structured corporate hub. The companies in Nepal have established an enterprise-grade benchmark for data security and quality, with a growing ecosystem of firms serving major US healthcare and data analytics providers. Companies like Techkraft Inc. exemplify this shift, holding ISO 27001:2022 certification and validating the location for sensitive US and European operations alongside other mature players in the region.

The Macro-Strategic Landscape of 2026

Shifting from Cost to Capacity

To understand the arbitrage opportunity presented by emerging hubs like Nepal, one must analyze the evolution of the global offshoring market.

- Generation 1 (Cost): Replacing expensive onshore developers with low cost offshore resources.

- Generation 2 (Process): Focus on CMMI certifications and industrial scale (India’s rise).

- Generation 3 (Innovation): The rise of “Innovation Centers” in Eastern Europe and Latin America.

- Generation 4 (Strategic Capacity): The current era. Companies seek “Production-Ready Pods” that autonomously execute complex roadmaps without micromanagement.

The 2026 opportunity lies in identifying geographies that can deliver this Strategic Capacity at competitive prices.

The India Plus One Imperative

Geopolitical and economic pressures are forcing a diversification of supply chains. According to a news report from Indian Express, while India remains the heavyweight with over 5.4 million professionals, the concentration of demand in hubs like Bangalore and Hyderabad has created a hyper-inflationary talent market. Voluntary attrition rates in India, while stabilizing, remain a significant factor in project volatility.

Global enterprises are now seeking to de-risk their engineering dependencies by adopting an “India+1” strategy. This search focuses on secondary hubs that offer cultural compatibility, specifically regarding English language and education systems, without the risks of market saturation.

Inflationary Pressures in Southeast Asia

Vietnam has seen explosive growth as a digital hub, moving beyond its “manufacturing alternative” reputation to become a serious IT contender. However, demand has outstripped supply. This has led to a talent shortage of roughly 200,000 engineers. This mismatch drives wage inflation and “job hopping.” While Vietnam remains strong for embedded systems and software, the talent crunch is compressing the cost-benefit margins that previously defined the region.

The Talent Stability Index

The High Cost of Employee Turnover

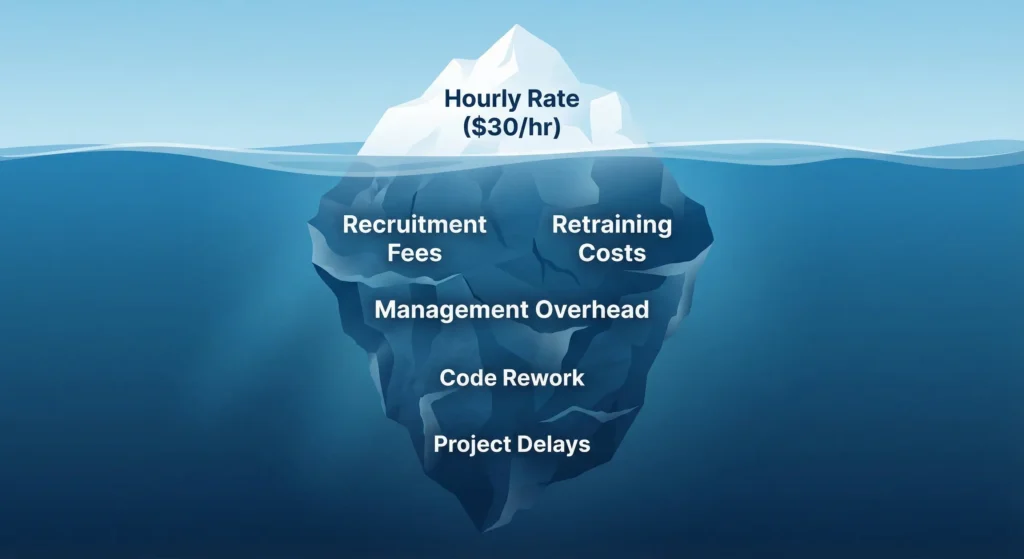

When a developer leaves, they take with them the tacit knowledge of the codebase, business logic, and architectural decisions—while also triggering team morale declines, productivity dips of 20-37%, project delays, and recruitment burdens. These compound into technical debt from inconsistent practices and a total replacement cost of 1.5-3x annual salary, covering onboarding ramps of 3-12 months, velocity loss, burnout cycles, and amplified debugging.

The primary risk of offshoring is not the hourly rate, but the attrition rate. A team that turns over 25% of its staff annually is essentially rewriting its own onboarding documentation rather than shipping features. The “Bait and Switch” phenomenon is a direct consequence of this instability. This occurs when a vendor sells a senior team but delivers a junior one due to attrition.

The Saturation Challenge in India

India’s IT sector has historically struggled with high attrition. While rates have stabilized from the post-pandemic peaks of 25%, voluntary attrition in India remains among the highest in the APAC region.

- Attrition Metrics: In 2024-2025, voluntary attrition rates in the Indian IT sector are hovering around 11.9% to 16.9%, depending on the specific sub-sector and city. For high-demand skills like AI, Data Engineering, and Cloud Architecture, these rates can be significantly higher. This is largely due to Global Capability Centers (GCCs) aggressively poaching talent from service providers.

- The Job Hopping Culture: The concentration of thousands of tech companies in cities like Bangalore creates a culture where “job hopping” is the primary mechanism for salary growth. It is not uncommon for developers to switch jobs every 1.5 to 2 years for a 30-50% salary hike. This creates a structural instability for long-term engagements.

- Impact on Delivery: High attrition forces outsourcing providers to maintain a “bench” of resources to plug gaps. This often leads to the assignment of under-qualified staff to ongoing projects to maintain billing continuity. This is the root cause of the “Bait and Switch” complaint.

Demographic Churn and Talent War in Vietnam

Vietnam’s workforce is young and dynamic, but this demographic dividend comes with high mobility.

- Gen Z Mobility: Gen Z workers in Vietnam are exhibiting increased job-hopping behaviors.

- Talent Shortage: With a shortfall of nearly 200,000 engineers, poaching is rampant. Multinational corporations entering Vietnam often drain the talent pool from local outsourcing firms. They do this by offering salaries that local vendors cannot match without raising rates significantly.

- Quality Fade: This intense competition leads to a risk known as “Quality Fade.” In this scenario, the best talent is moved to the highest-paying new accounts, leaving legacy clients with junior replacements or under-resourced teams.

The Stability Advantage in Nepal

Nepal presents a distinct anomaly in this data set. The retention metrics in Nepal’s organized IT sector are structurally superior due to several socio-economic factors that create a “Sticky” workforce.

- Less Saturated Market: Unlike Bangalore or Ho Chi Minh City, Kathmandu does not host thousands of competing MNCs aggressively poaching staff. This results in significantly lower turnover. Senior engineers tend to stay with stable, high-growth employers for longer durations. Market data suggests average tenure in top-tier Nepali firms often exceeds 3-4 years, providing a continuity advantage.

- Employer of Choice Dynamics: For a Nepali engineer, working for an export-oriented firm like Techkraft or other established US-serving entities represents a top-tier career opportunity. In India, such a role might be one of hundreds of options. This elevates the employee’s commitment to the role and the client product.

- Cultural Emphasis on Loyalty: Studies on Nepalese work culture indicate a strong correlation between job satisfaction, work environment, and retention. Factors such as clear career paths and the prestige of working on global products are powerful retention tools in Nepal.

- Mitigation of Brain Drain: While migration is a factor, the organized IT sector in Nepal offers salaries that provide a high quality of life relative to the local cost of living. This incentivizes talent to stay in the country. This contributes to a stable senior layer in the workforce.

Comparative Stability Index (2025)

| Feature | Nepal | India | Vietnam |

| Average Tenure (Senior Dev) | 3.5 – 4 Years (Est.) | 2 – 3 Years | ~2.2 Years |

| Voluntary Attrition Rate | Low (<10% Est.) | 11.9% – 16.9% | High (Due to Shortage) |

| Market Saturation | Emerging (Low Competition) | Saturated (High Poaching) | Overheated (Talent Shortage) |

| Risk of “Bait & Switch” | Low (Transparent Teams) | High (Bench Management) | Moderate (Capacity Constraints) |

| Impact on Roadmap | High Predictability | Volatility Risk | Staffing Delays |

The Economic Arbitrage

Efficiency and Hourly Rates

A direct comparison of hourly rates reveals that Nepal offers a significant cost advantage, particularly at the senior level. However, the true arbitrage is found in the efficiency of that rate. We term this the Total Cost of Ownership (TCO).

- India: Rates for senior developers have hardened significantly. In 2026, a senior developer in India commands between $40 and $60+ per hour. Specialized roles like AI and ML push these rates significantly higher. The “blended rate” often hides the fact that clients are paying senior rates for mid-level output due to title inflation. A “Senior Engineer” in India might often have only 3-4 years of experience due to rapid promotion cycles used to retain staff.

- Vietnam: While historically cheaper, Vietnam’s rates are climbing due to the talent shortage. Senior developers now range from $30 to $40+ per hour. The rapid wage inflation suggests these rates will continue to rise throughout 2025 to close the gap with India.

- Nepal: Nepal consistently offers the most competitive rate structure. Senior developer rates typically fall in the $28 – $40 range.Crucially, because the cost of living in Kathmandu is lower than in Bangalore or Ho Chi Minh City, these rates still support a high quality of life for the engineer. This reduces the pressure for wage-spiral inflation.

Salary Inflation and Budgeting

For planning a 3-year engineering budget, predictability is key. The data for 2025 indicates a diverging trend in salary increments:

- India: Projected salary increase of 9.5% in 2025, matching the high inflation of previous years. This indicates that the cost of an Indian team will compound significantly over a multi-year engagement.

- Vietnam: Recruitment demand and talent shortages are driving salary increases, particularly for mid-to-senior level roles in technology. The shortage of 200,000 engineers ensures that this inflationary pressure will remain high.

- Nepal: While the sector is growing, the overall labor cost pressure is lower due to a steady supply of graduates entering a market with fewer absorbing MNCs. This allows for more predictable long-term budgeting for clients. The “stickiness” of the talent means that annual raises can be tied to performance rather than market-correction.

The True Seniority Advantage

A critical insight from the analysis is the definition of “Seniority” in different markets.

- In India, due to rapid expansion and high churn, title inflation is rampant. A “Senior Engineer” title is often granted to individuals with 3-4 years of experience to justify higher billing rates.

- In Nepal, due to the slower, more organic growth of the ecosystem and lower churn, a Senior Engineer typically possesses true 5-7+ years of experience. They have often grown with the company and possess deep institutional memory.

Clients sourcing from firms like Techkraft are effectively buying true seniority for the price of a mid-level resource in India or Vietnam. This is the core economic arbitrage: Higher Capability per Dollar.

Table: 2025 Comparative Hourly Bill Rates & Economics (USD)

| Role Level | Nepal (Est.) | India | Vietnam |

| Junior Dev | $12 – $18 | $18 – $25 | $20 – $30 |

| Mid-Level Dev | $18 – $28 | $25 – $40 | $25 – $40 |

| Senior Dev | $28 – $40 | $40 – $60+ | $30 – $40+ |

| Wage Inflation (2025) | Moderate (Predictable) | 9.5% (High) | High (Shortage Driven) |

| Cost Savings vs US | ~75-80% | ~60-70% | ~65-70% |

Engineering Maturity and Education

English Medium Instruction in Engineering

Perhaps the most overlooked yet critical differentiator for Nepal is the language of education. In software engineering, English is not just a communication tool. It is the language of the code itself, the documentation, the libraries, and the architectural patterns.

- Vietnam: Technical education occurs primarily in Vietnamese, with English as a separate subject; even in top universities like Hanoi University of Science and Technology, core engineering courses use Vietnamese textbooks and lectures. While TOEIC scores average 500-600 (improving to ~650 by 2025), this creates hurdles in nuanced architecture debates or agile standups with Western clients.

- India: Engineering programs at IITs/NITs are fully English-medium, fueling its outsourcing dominance. However, Tier-2/3 colleges (80%+ of output) suffer inconsistent pedagogy, accents, and “Globish” (simplified English), per HBR analyses on communication gaps in offshore teams.

- Nepal: A distinct advantage for Nepal is the prevalence of English Medium Instruction. Private schools (70%+ urban enrollment) use English from primary level, extending to engineering at Tribhuvan University (IOE) and Kathmandu University—fully English-medium per official curricula. This immerses graduates in native technical English, matching US hires in stack fluency (React/Node/AWS docs) and eliminating translation lags for “production-ready pods.

Table: English Medium Instruction (EMI) and Language Proficiency

| Country | Education System Language | English Proficiency Index (EPI) Score | Key Differentiator |

| Nepal | Predominantly English-medium for engineering (e.g., Tribhuvan University) | 512–514 (Moderate Proficiency) | Graduates learn concepts in English, eliminating “Globish” friction, and score higher in the aggregate EPI than India and Vietnam. |

| India | English-medium, but with varying quality between top-tier and Tier-2/3 colleges | 484 (Low Proficiency) | Quality is inconsistent across institutions; large rural population pulls down the aggregate score. |

| Vietnam | Primarily Vietnamese-medium for technical courses | 500 (Moderate Proficiency) | English is taught as a subject, not the technical medium, which can be a barrier for deep architectural discussions. |

The data explicitly validates the “Nepal Advantage.” Despite India’s colonial history with English, Nepal’s aggregate proficiency in the tested demographic is superior. This is directly attributable to the dominance of private English-medium schools in Nepal’s urban centers. This results in fewer “Can you repeat that?” moments and higher comprehension of complex business requirements.

Ecosystem Maturity and Security

Nepal’s tech sector has matured far beyond freelance work. It now hosts major development centers for US healthcare and data analytics companies.

- Global Benchmarks: The ecosystem hosts large operations for several multinational US healthcare technology and data analytics firms. These centers serve Fortune 500 clients under strict compliance frameworks, proving the region’s capability to handle sensitive data at scale.

- Compliance Standards: The ecosystem has standardized on global security protocols. Leading firms, including Techkraft Inc., are ISO 27001:2022 Certified. This ensures that data security, risk management, and process rigor meet international enterprise standards, mirroring the compliance levels found in established hubs like Bangalore or Manila.

Operational Resilience and Infrastructure

Power Infrastructure and Reliability

Fears regarding power and internet instability in Nepal are largely rooted in outdated stereotypes. In reality, Nepal has transitioned from a power-deficit nation to a net exporter of electricity.

- Power Exports: In 2024 and 2025, Nepal began exporting significant surplus electricity to India and Bangladesh. This trade generates millions in revenue and demonstrates a robust energy grid. This surplus ensures high reliability for industrial sectors within Nepal (source: ).

- Resilience: The Nepal Electricity Authority (NEA) has eliminated load shedding for industrial sectors. Additionally, standard operating procedures for firms like Techkraft include enterprise-grade diesel generators and UPS backups to guarantee 100% uptime.

Connectivity and Redundancy

To ensure consistent uptime, enterprise providers in Nepal utilize dual or multiple ISP connections. This multi-vendor approach ensures that if one provider experiences an outage, traffic is automatically rerouted to an alternative link, maintaining business continuity for critical operations. By leveraging redundant fiber-optic networks from distinct upstream carriers, companies can eliminate single points of failure without relying on external or restricted infrastructure.

Cultural Alignment and Communication

Time Zone Compatibility

- Nepal (GMT +5:45): This unique time zone offers a workable overlap with US mornings (EST) and Australian business hours.

- Strategy: Firms like Techkraft utilize an “Aligned Overlap” model (e.g., 12 PM – 8 PM NPT). This shift provides a solid 4-hour crossover with the US East Coast morning (approx. 7 AM – 11 AM EST). This allows for synchronous stand-ups, sprint planning, and architectural reviews without forcing the offshore team into a graveyard shift. Avoiding the “graveyard shift” is crucial for retention and long-term health. This is a lesson often ignored by 24/7 BPO operations in India.

- Vietnam (GMT +7): Vietnam is 1 hour and 15 minutes ahead of Nepal. While seemingly minor, this pushes the US overlap further into the late evening for Vietnamese teams.

Western Work Culture Adaptability

A significant majority of Nepal’s tech sector, specifically 77.8% of export companies, is focused on serving US clients, resulting in heavy exposure to the US work culture. This creates a cultural osmosis where Western professional norms like candor, punctuality, and flat hierarchy are more readily adopted in Kathmandu’s tech hubs compared to the rigid hierarchical structures often found in traditional Vietnamese or Indian firms.

- Adaptability: Research on Nepali IT employees indicates a high degree of “career adaptability” and a willingness to adopt telecommuting and flexible work structures. These structures mirror Western tech companies.

- Radical Candor: The “Push Back” protocol, where engineers are encouraged to flag bad logic rather than blindly follow orders, is culturally supported by a younger generation of Nepali engineers who value professional growth and technical excellence.

Conclusion

The data for 2026 suggests a clear stratification in the market. While India remains the volume leader and Vietnam represents a dynamic manufacturing and IT hub, Nepal is establishing itself as the Efficiency & Quality Champion for software engineering.

The presence of ISO 27001 certified companies like Techkraft proves that the region is ready for enterprise-grade scrutiny. For the “Overloaded Technical Leader” or the “Economic Buyer,” Nepal offers a compelling arbitrage:

- Code Continuity: Through higher retention rates (3.2+ years).

- Communication: Through English-medium foundations in schools and universities.

- Security: Through ISO-certified governance and Western legal frameworks.

In the search for the next great engineering arbitrage, the smart money is diversifying into high-retention hubs. Nepal is no longer just a destination for mountaineers. It is a base camp for resilient, high-performance software engineering.